Don't wait for a crisis

Protect Your Family from Unnecessary Stress and Trauma

Get your Wills, Lasting Power of Attorney and Estate in Trust well before you need it.

The best time to sort out your "paperwork" is before it is needed

Don't leave your wishes to strangers to decide

Health

Should you become unable to make your own decisions, who do want to carry out your wishes?

Your appointed person or a stranger?

Wealth

When you need help with your financial arrangements, who do you want to decide?

Your appointed person or a stranger?

Family

Do you want to give your family problems and heart ache or a smooth process when the time arrives?

We Understand This is a Difficult Situation!

At Redlake, we understand the struggles that come with planning for the future. That's why we stress the importance of taking control of your own decisions and planning ahead. Wills, LPAs, and trusts are essential tools that can provide peace of mind for both you and your loved ones.

By taking the time to properly set up these arrangements in advance, you can ensure that your wishes are respected and any potential legal issues are avoided.

Lasting Power of Attorneys for Finance and Health will keep important decisions within your control.

The best Inheritance Tax bill is not tax bill! Estate Trusts can help

A proper Will makes sure your wishes are followed

Probate is stressful and complicated. Let an expert help your loved ones

Don't Wait for a Crisis:

We never know what the future holds, and that's why estate planning is so important. There's no better time to start taking these steps than now, before a crisis emerges. Writing a will, setting up a Lasting Power of Attorney (LPA) or establishing a trust may not be the most exciting way to spend your time, but they are vital tasks that can bring you peace of mind. Taking care of these important measures now can help ensure that your wishes are carried out and your loved ones are protected in the long run. Don't put off estate planning, because it's never too early to be prepared.

Protect Your Family's Future

Get a Head Start on Will, Power of Attorney, and Trusts

60% of People

Die Intestate (Without a Will)

That is 31 Million people who are leaving a problem for family behind them.

£6.1 bn paid in Tax

Inheritance Tax

The vast majority of Inheritance Tax is due because of a property. This can be reduced significantly with an appropriate Estate Trust

Probate is 4x

Lack of a Will delays Probate

On average it take 4 times longer to pass probate (access the money) if there is no will.

Our Commitment to You

Comprehensive Support

Our dedicated team is here to support you every step of the way, from the initial consultation to the final distribution of assets. We'll work hand-in-hand with you to navigate the complexities of probate, ensuring a hassle-free experience for you and your family.

Expert Legal Guidance

With years of experience in estate administration, our probate specialists possess the knowledge and expertise to address any legal challenges that may arise during the process. Rest assured that your estate will be managed in accordance with the law and your wishes.

Affordable Pricing

We believe that everyone deserves access to professional probate services, regardless of their financial situation. That's why we offer competitive pricing and flexible payment options to accommodate your needs and budget.

Affordable Estate Planning within Your Reach

We understand that creating a legally binding will and securing the future of your loved ones can seem like a daunting task. However, we believe that everyone should have access to affordable estate planning. That's why we offer easy-to-use tools to help you create legal wills, trusts, and probate documents at a fraction of the cost of other providers. When you work with us, you can have peace of mind knowing that your family's future is protected and your wishes will be carried out.

Ray J

Fantastic Will Writing Service. Simplicity from start to finish. From beginning to end it took 9 working days.

This was my first ever experience of making a Will, and at 70 years of age, I feel a burden has now been lifted off my shoulders. Highly recommended!

Marguerite W

I’m very happy with the service provided by Phill and Gaynor at Redlake UK Limited.

I needed a lot of help to make my Will and LAPs which was always provided in a very efficient and friendly manner. I couldn’t ask for more.

Read our Latest Blog Posts

Will Writing, Lasting Power of Attorney, Probate & Estate Planning

Writing a Will: Ensuring Your Wishes are Honoured

“Writing a will is not just about securing your assets; it's about preserving your legacy and ensuring your loved ones are taken care of when you're no longer here.”

Creating a will is an essential step in securing your assets and ensuring that your money, property, possessions, and investments, collectively known as your estate, are distributed according to your wishes.

It provides you with the peace of mind that your loved ones and the causes you care about will be taken care of after you're gone. Let's explore the key steps involved in writing a will.

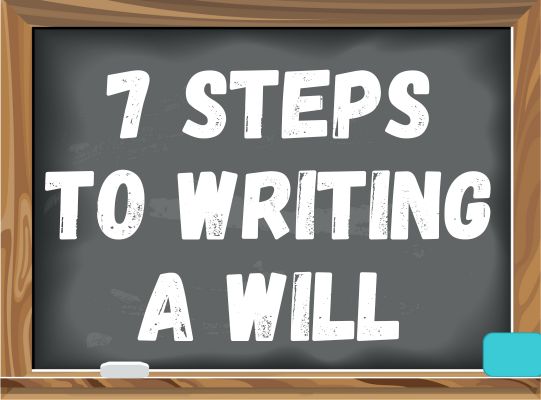

Step 1: Value Your Estate

To begin, compile a comprehensive list of your assets and debts. This list should include your home and other properties, bank and building society accounts, savings, investments, insurance policies, pension funds, motor vehicles, jewellery, antiques, and other personal belongings. Equally important is accounting for your debts, such as mortgages, credit card balances, loans, and overdrafts.

Remember to regularly update the valuation of your assets, as their worth may change over time.

Step 2: Decide How to Divide Your Estate

Clearly defining your intentions for the distribution of your entire estate is crucial. Consider who you want to benefit from your will, whether you have any specific gifts for particular individuals, and where any remaining property or money should go after funeral expenses, administrative costs, legacies, and taxes have been settled. Additionally, contemplate what should happen if any of your beneficiaries pass away before you.

Step 3: Leaving a Charitable Donation

If you wish to leave a legacy to a charitable organisation in your will, ensure that you provide accurate and complete details, including the charity's full name, address, and registered charity number. It's essential to avoid any errors in this information to ensure your chosen charity receives the intended gift.

Step 4: Choose Your Executors

Executors play a crucial role in administering and distributing your estate according to your will. Given the responsibility and workload involved, it's important to carefully select trustworthy individuals to carry out these duties. Take the time to consider the right people for this role.

Step 5: Writing Your Will

Several options are available when it comes to writing your will, but unless you know what you're doing, it's important to get some outside help to guide you through the process.

At Redlake, we're more than happy to help, regardless of which stage of the will writing process you're in. If you're interested, checkout our services page after reading this blog, or CLICK HERE to kickstart the process and book in for an initial consultation.

Step 6: Signing Your Will

To validate your will, it must be signed in the presence of two independent witnesses. All three individuals should be in the same room when the signing occurs. It's important to follow the proper signing protocol, as an incorrectly signed will is not considered valid. Ensure you understand the witnessing requirements, especially considering any temporary modifications due to the COVID-19 pandemic.

Step 7: Safely Storing Your Will

After signing your will, store it securely. Options include leaving it with a solicitor, bank, safely storing it at home, or utilising the services of the Probate Service. Inform your chosen executors about the location of your will, and avoid attaching any additional documents to it, as this could lead to doubts regarding its completeness.

Ensuring Validity and Updates:

To guarantee the validity of your will, it must be in writing, signed by you, and witnessed by two individuals. Additionally, you must have the mental capacity to understand the will's effect and make it voluntarily, without pressure from others. Remember to explicitly state in your will that it revokes any previous versions, and destroy any earlier wills you may have.

Updating your will regularly, ideally every five years or following significant life events, such as the birth of a grandchild or a change in residence, is essential.

Need Some Help?

If you're feeling overwhelmed or unsure about the process of writing a will, we're here to assist you every step of the way. At RedLake, we specialise in helping individuals create legally sound wills, navigate estate planning, lasting power of attorney, and probate matters. Our team of experts is ready to provide personalised guidance tailored to your specific needs.

To get started, simply click here to book a consultation with one of our knowledgeable professionals. We'll ensure that your wishes are properly documented and your loved ones are protected. Don't leave your future to chance—let us help you secure your legacy today.